The U.S. economy keeps dodging obstacles

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- The U.S. economy will have the softest of soft landings

- Investors should ‘gobble up’ attractive coupon income

- Near-term pullback should not derail the bull market

Are you ready for The Next Level Up? While artificial intelligence and new technologies have captured the market's attention, this quarter we reminisce about the good old days and a key piece of technology that has endlessly entertained us all – classic video games. Regardless of how much or how little you played, the concepts portrayed in video games can easily be extended to the investing landscape. Whether playing the game or managing your finances, every ‘player’ must be well prepared and ready to face any obstacles that get tossed his/her way. Whether in video games or real life, the challenges get incrementally harder as you advance through each level. Stay tuned as we use classic video games to articulate our updated views on the economy and different asset classes.

- The U.S. economy keeps dodging obstacles | The economy has powered through many obstacles (i.e., weak global growth, sharp housing downturn, higher rates) over the last few years that could have derailed growth and tipped it into a recession. The economy is like the video game Frogger, who has to dodge cars and alligators to arrive safely at home. And while there are plenty of risks on the horizon (rising credit card balances, falling savings, slowing job growth), the consumer – who represents 70% of the economy – has remained healthy. And that’s mainly because the job market has not collapsed. Yes, there has been a marked slowdown in the pace of job gains, but the economy has been able to avoid the massive layoffs that typically lead to a recession. Another major factor that has kept the economy out of recession is all the fiscal spending by the government to incentivize the private sector to ‘reshore’ critical goods for security and healthcare needs. While we expect growth to slow from its current pace, an outright recession will likely be avoided (for now). Therefore, we upgraded our growth forecast from 1.7% to 2.1% in 2024.

- Investors are ‘gobbling up’ elevated bond yields | Yields across virtually all sectors of the fixed income market remain above their 15-year averages. This is good news for bond investors who get the opportunity to gobble up attractive coupons after years of historically low rates, just like Ms. Pac-Man gobbles up those pac-dots in one of our favorite old-school video games. Given our upgraded growth outlook, we modestly increased our year-end 10-year Treasury yield forecast from 3.5% to ~3.75%. However, as growth slows from its current pace and disinflationary trends continue (even if the descent is bumpy), investors can look forward to power-pellet performance in the form of price appreciation as interest rates should move lower once the Fed begins to cut rates (we’re expecting three this year). But with cash still yielding north of 5% and rates expected to remain volatile in the near term given the robustness of the economy, any uptick in yields presents a bonus opportunity to lock in attractive rates.

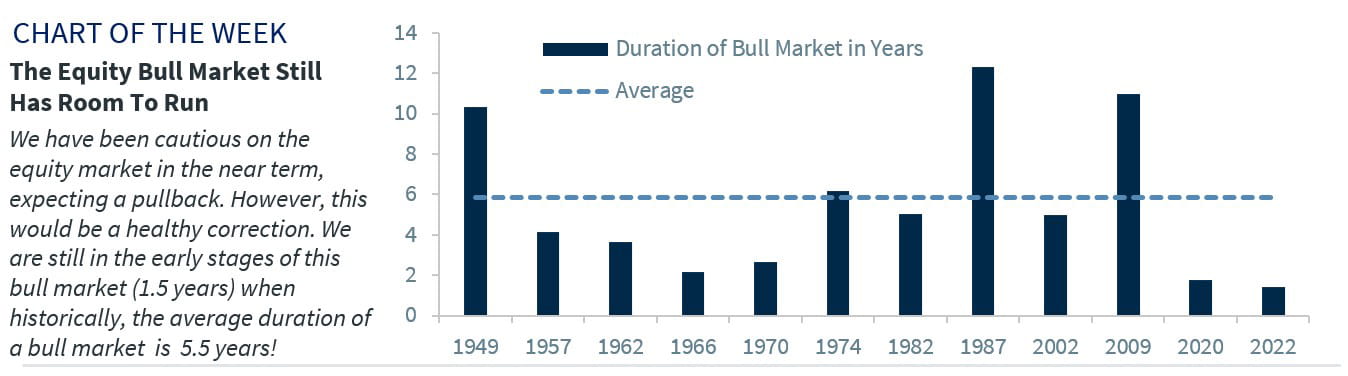

- U.S. equity markets power up like Super Mario | The S&P 500 has gotten off to a strong start to the year, climbing over 10% in 1Q24. The lasting strength in the economy and improving earnings outlook have been key reasons behind the market’s upward momentum. This has allowed us to upgrade our earnings forecast from $225 to $240, which in turn raises our year-end target for the S&P 500 from 4,850 to 5,200 (leaving the earnings multiple (P/E) unchanged at 21.5x). Earnings will need to take over as the key driver as the P/E multiple is priced for perfection with valuations in the 93rd percentile over the last 20 years. While a near-term pullback may be on the horizon (the market typically has 3-4 5% pullbacks each year), our longer-term optimism remains intact as the current bull market (which has lasted one and a half years) is still in its infancy as the average duration of a bull market is over five years. Our favored sectors include Info Technology, Industrials and Health Care. A broadening in performance and improving macro backdrop should benefit small caps, which trade at attractive valuations.

- Select opportunities in international equities | Our views on international equities mimic the top developers of video games, which is dominated by franchises in the U.S. and Japan. We have not wavered in our preference for U.S. equities over developed Europe. While Europe has attractive valuations, the U.S. is far superior when it comes to economic growth, earnings trends and sector weightings that align with our favored picks. While Japanese equities have soared over the last year, they still have room to run powered by a weak yen, corporate reforms and share-holder friendly behavior (i.e., share buybacks). Our views on emerging market equities remain intact, with steep valuation discounts (well below historical averages), robust earnings growth and tailwinds from ‘friendshoring‘ trends (diverting manufacturing away from China to more business-friendly nations).

For a more in-depth discussion of our Quarterly Outlook and key insights from our quarterly Investment Strategy Sentiment Survey, please register for Monday’s webinar using the link above. Follow my Twitter and LinkedIn accounts for the replay or check RJ Net.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.